I was hoping to do Tittle Tattle this afternoon, but I am behind on Hurricane prep work as we face another one of these storms. This will be our third since moving to Florida last year. Stopped by the feed store to make sure I have enough for the animals and took a picture of the sign. How to keep the chicken coop from becoming a flying projectile? Stay tuned. Planning to do a live stream with my dad from the beach tomorrow.

Whoever invented tabbouleh is a genius. I started making it because our local regenerative produce farm, Growing Back to Eden, has the most beautiful parsley. I had no idea how healthy it is! Parsley is a vitamin K super green, not to mention it’s packed with so many other nutrients. It makes regular salad greens look lazy. I opt out of the bulgar wheat and just use tomatoes, onion and mint. Back when I bought tabbouleh, I’d notice it was often made with cheaper oils like sunflower or canola. I use olive oil and a dash of sea salt. It’s so easy and if you make a lot at once, it holds pretty well in the fridge for a week. Don’t forget your Green Pasture products (cod liver/butter oil, skate oil, muscle rub, and more!) with the link below.

GREEN PASTURE:

https://www.greenpasture.org/

(promo code “ALISON” for 10% off all products)

Fermented foods are not just good for people, they are great for animals. Fermenting chicken feed is so easy and it makes the grains far more nutritious. All you do is put your feed in a bucket and add water until the water covers the feed. Let it soak for 1 to 3 days and you should see it start bubbling. It’s fermented and ready to feed your chickens. You will probably have to add more water after your initial mixture grows in volume to make sure there is always a little bit of water covering the top. This prevents mold. Our chickens love their fermented feed and will leave any dry feed untouched if their fermented feed is in front of them.

We met Corona at 4H yesterday, she’s a one-eyed barrel racing horse. She had ocular melanoma and her eye was surgically removed last year. She has made a full recovery and is back to barrel racing! She has won over $400 in local competitions in just a few months with her young rider.

😧

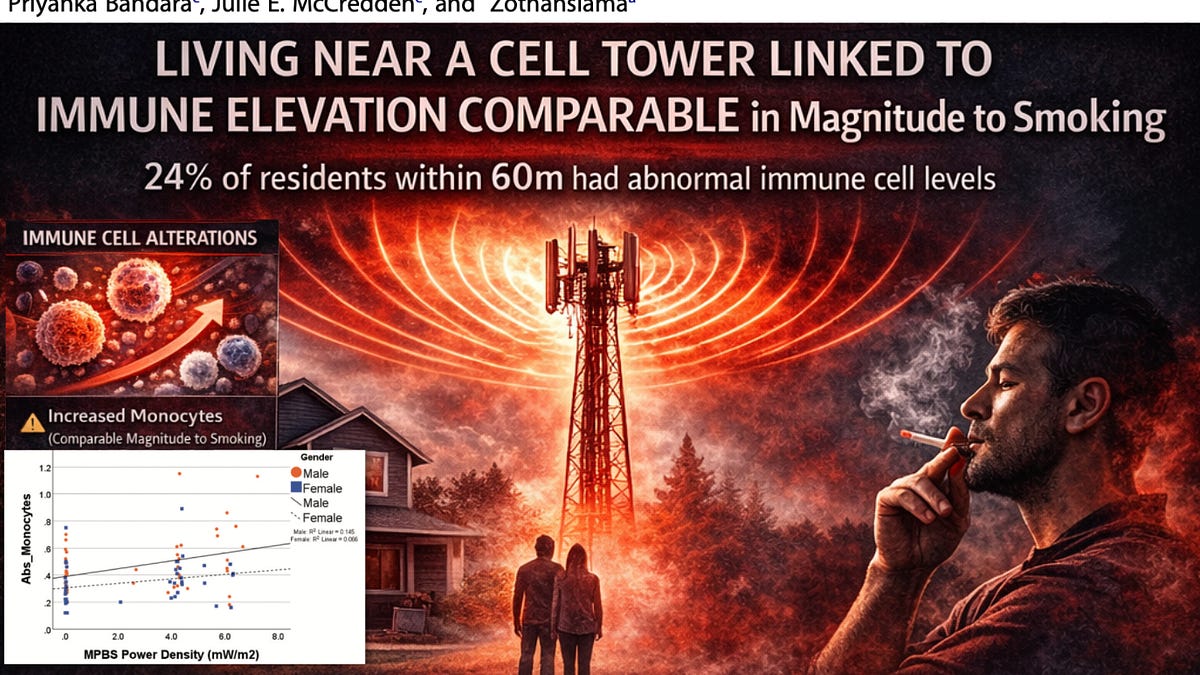

WiFi signals can measure heart rate—no wearables needed - News

https://news.ucsc.edu/2025/09/pulse-fi-wifi-heart-rate/

https://open.substack.com/pub/jessicar/p/automation-has-it-stolen-what-it?

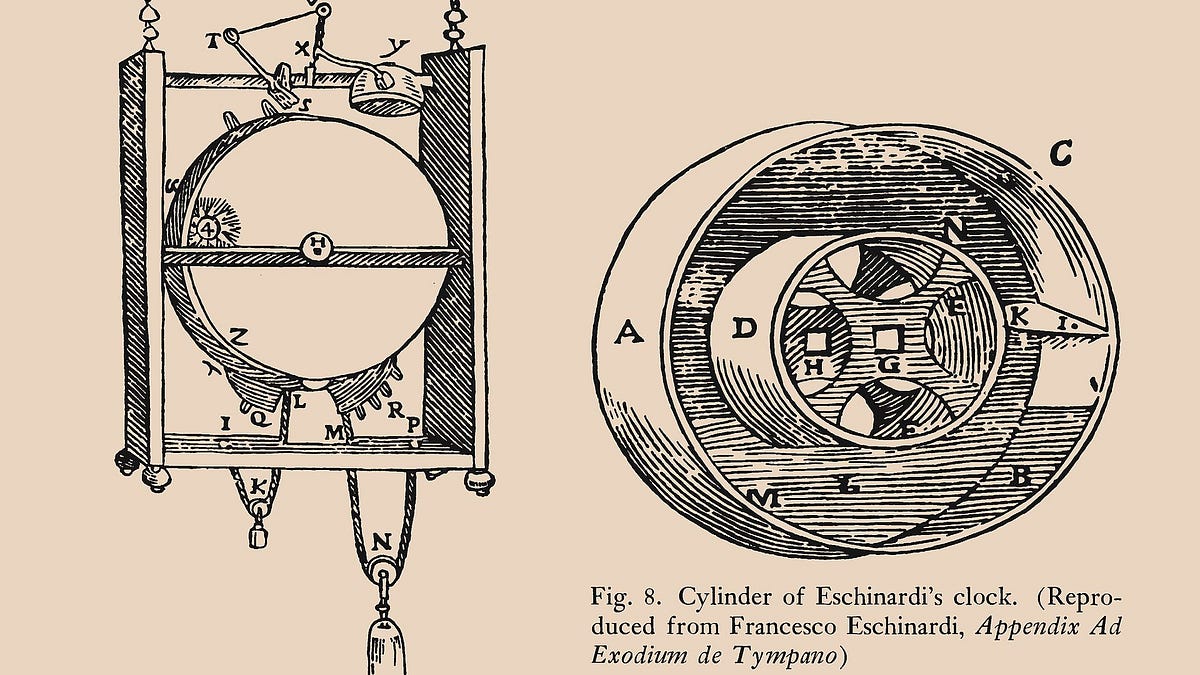

I am completely for regressing to analog. I would be a Luddite. I am looking forward to our arts and crafts backlash movement